The Value of Talent at Tesla Versus GM (Brains Versus Brawn)

This week, it was reported that Apple is now Tesla's top source for new talent. I guess that explains why the market value of Tesla is 97% higher than the value of its tangible assets (year end 2013); in financial terms, the market expects the present value of future cash flows to exceed the value of its tangible assets by that much. The brainpower that is takes to build a wildly innovative electric car business manifests itself in genius: trade secrets, patents, and other intellectual capital that will (hopefully) drive that cash result in the future. Keep in mind, Tesla is still a start up that has not delivered ROIC (return on invested capital) yet, but big money bets that it will. I for one can't wait to dig into the 2014 10-K after today's earnings release covering the past year!

By comparison, General Motors Company had an estimated intellectual capital value of 34% at the end of 2013. While GM has a foothold in the futuristic electric and hybrid market, that is not its mainstay. Although it owns valuable brands and patents, its value is more heavily weighted in its considerable tangible assets such as inventory, factories, etc.

Why are Tesla and GM worth talking about? Even though they are two automobile companies, they have little else in common. Tesla has more in common with Amgen and Google than it does GM. Those companies are all powered and valued by the same thing: brainpower that translates into intellectual capital (IC) that shareholders pay for.

But they're not alone.

All companies possess some degree of intellectual capital. Brands, patents, proprietary processes and methods, customer partnerships and so on represent intellectual capital. These are, in fact, the main cash flow drivers for many companies today. Sales bring in the cash, but intellectual capital provides the means to be able to sell in the first place --- the brains are in fact the goldmine. And guess what? The only source of all this intellectual capital is talent. But not all talent – only certain critical roles in a company create the bulk of business value.

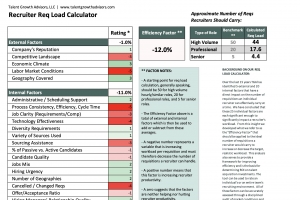

In each industry and company within, certain roles are more critical than others to creating value. Researchers, brand managers, engineers, software architects....it varies by industry and company, but there is a data-based way to analyze your business and pinpoint the most essential functions and roles. Let’s face it: all of your talent is important, but some talent is precious.

It’s a guess, but I bet the talent Tesla is stealing from Apple is not cheap and doesn't jump ship easily. Not as easily as, say, an accounts payable manager Tesla just hired from Walmart (I’m making this up). There is a reason shareholders pay $18 billion more for Tesla than its tangible assets are worth, and that reason don't come cheap, but it is well worth the effort!

The lesson for all of us – wherever we work: Do we know what our most precious talent is? Are we over-investing in finding and keeping it?

Meanwhile, I can't wait to download Tesla’s 2014 numbers! Stay tuned for another post on that.

Want to learn more about how business value, intellectual capital and talent are connected? Pre-order my new book: Talent Valuation: Accelerate Market Capitalization through Your Most Important Asset.

Share this Article

Learn more about our unique approach to Talent Strategy Formulation.