GE Jumps Ahead in Intellectual Capital Share-of-Value in 2016 Study

What’s the matter with Owen?

Not much actually – he’s bright enough to recognize that GE is morphing from the industrial to the information age – although apparently, not as quickly as some shareholders might have expected. The “What’s the Matter with Owen?” ad campaign debuted in 2015 and features a newly-minted GE employee who works as a programmer/developer, but can’t quite explain to friends or family what he and his new company actually do all day. A Forbes article reported that job applications to GE spiked an amazing 8x following the launch of the “Owen” campaign.

Intellectual Capital Index

In Talent Growth Advisor’s newest annual study, GE’s percentage of intellectual capital value to total enterprise value – its Intellectual Capital Index (ICI) - jumped significantly in 2016. The ICI measures the degree to which a company’s value is derived from intellectual capital, the stuff that in the end only talented people can create and sustain. By shedding most of GE Capital during 2015, GE eliminated a significant part of its business which, as is the case with banking institutions, did not derive its value from intellectual capital and thereby diluted the ICI, the potential value and value creation prospects of GE.

Is GE an industrial company or a technology company?

GE’s research and development spending, a hallmark of technology and other innovation driven companies, is twice that of its nearest competitor – nearly $5 billion in 2016. The value of its customer software revenue (primarily its internally-developed Predix system) would qualify as a standalone Fortune 500 company. So, yes, it is an industrial company with plenty of tangible assets, but it has a ton of intellectual capital built into its products and services. We measured GE’s Intellectual Capital Index to be 83% of its enterprise value.

Despite these positive signs of evolution at GE, activist shareholder, Trian Fund Management, recently gained a board seat, CEO Immelt departed after a protracted downturn in the company’s share value over the last year, and the company reported disappointing earnings results. GE may be moving in the right direction, but clearly not fast enough for all investors.

Trian supports the sale of GE Capital – a tangible capital-intensive business which GE relied on for nearly half of its earnings. In a Trian white paper from late 2015, GE was both praised for its progress and questioned about its focus and urgency. ‘Transformation Underway…but Nobody Cares’ kind of summed up the point of view.

When the Dust Settles

While GE has had a few temporary hiccups, and senior management upheaval is never pleasant, when the dust settles strategically and the right human capital plan is on track, the company could achieve the Trian model’s $40-50 implied value per share.

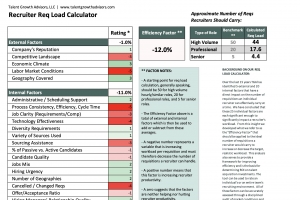

The stakes in terms of talent for GE have been raised with its business transformation and increased reliance on intellectual capital (IC) to drive cash flow. GE must compete successfully and consistently for top talent in critical roles, the source of IC, in an environment that is more competitive than ever. This means that GE will have to:

- Identify and define the IC that comprises 83% of the company’s value

- Determine the most critical roles (verticals) to creating and building on its IC

- Design acquisition, compensation, and development practices to over-index against those roles

- Resource and execute with urgency

The Economic Reality

Even mammoth General Electric faces the economic reality of scarce resources when it comes to talent and must embrace the idea that the most unfair thing a company can do is to treat all roles equally. After all, applying a traditional investment philosophy and execution framework to people based on level alone (executive, mid-level, entry-level – like Owen) is ultimately disastrous for all employees. Such an old-school approach fails to acknowledge the need to invest disproportionally in the hiring and retention of those in critical roles. By doing so, GE – and Owen – will benefit by isolating, investing in and optimizing the sources of GE’s future value.

Is something wrong with Owen? Not at all. In fact, GE will need many more Owens to get where they’re trying to go.

Share this Article

Learn more about our unique approach to Talent Strategy Formulation.