Why Your “Post-Pandemic” Business Strategy Depends on HR

The global pandemic caused the U.S. stock market to lose a third of its value almost overnight and the economy required a $2 trillion injection in an attempt to stabilize lives and markets. It might seem over, but the effects are ongoing and more unpredictable than anyone would have hoped for. Americans, our economy and the overburdened healthcare system continue to face daunting challenges which will be with us for the foreseeable future.

How businesses were impacted from a talent standpoint across our economy ran the gamut. On the extremes, some industries shed tens of thousands of jobs (travel, hospitality, in-store retail) while others hired in similarly large numbers (healthcare, e-commerce, technology, consumer products, etc.) Everyone in the middle experienced disruptions due to greatly accelerated remote work arrangements, supply chain impediments, as well as financial pressures that may still lead to workforce reductions. Many of these organizations permanently changed the way they conduct and staff their businesses. In the last year and a half, the economy recovered and then quickly whiplashed into being overheated, turning new hiring behaviors and many things that had been learned upside down.

One factor that evolved over the past several decades and remains unscathed through uncertain times is how value is created. The majority of value that is created in most companies, even beyond the obvious industries such as technology, pharmaceutical and consumer products, is directly related to the intellectual capital that drives cash flow today. Brands, patents, research, and technologies, as a few examples, make up more than 80% of the average company’s market value already – and in many cases, well beyond that. Companies like Apple, Visa, and Microsoft are almost exclusively valued for their intellectual capital rather than the relatively few tangible assets they own. Perhaps surprisingly, even companies with large manufacturing and warehousing operations such as P&G, Home Depot, UPS and Caterpillar are valued more for the intellectual capital they have accumulated than for the substantial physical assets they have in property, plants and equipment. Companies' market values are created, now and into the future, through growing their intellectual capital and for this there is only one source.

The majority of value that is created in most companies is directly related to the intellectual capital that drives cash flow.

All of the intellectual capital, and most of the market value, for today’s companies originates with people rather than with the tangible assets of the industrial age. Regardless of their evolution, all companies intuitively recognize this fact; most continue to publicly acknowledge that “talent is our most important asset”. But many companies, especially those that are greater than 30 years old, have not designed or codified a talent strategy that matches this modern economic reality. Even though the “War for Talent” talk has been popular for years, many companies continue to embrace outdated beliefs about the reliability and availability of highly skilled talent.

It is then clear that with today’s fact pattern, any SWOT or other form of analysis providing the backdrop for companies’ talent strategies pre-March 2020, should be unceremoniously discarded. There are new talent risks that supersede those previously existing, and they require different plans and capabilities to remediate.

Our conversations with clients indicate a significant change underway. Strategies for driving post-virus business recovery have been created and are now being implemented aggressively. But too frequently, HR concerns continue to be dismissed or minimized – at these organizations' peril. Now more than ever, there is a clear need to identify the right few critical roles and build strategies to ensure high-performing, diverse talent is hired and retained these jobs in an uninterrupted way.

The clear and urgent strategic need: identifying roles critical to the creation of business value and designing strategies for ensuring the right people are in these jobs.

These critical roles vary by industry and do the work that produce the valuable intellectual capital, and ultimately cash flow, for their companies – the value drivers. Identifying them usually means identifying vertical parts of the organization that house this talent rather than horizontal, hierarchical bands of jobs as was the practice in days gone by.

New Risks

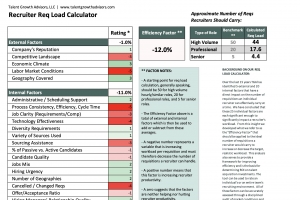

The talent-related issues that loom large in the media – "quiet quitting", candidate ghosting, early and more frequent attrition, disengaged employees, poor performance, etc. – are real and can tax even the most robust HR team. Without a framework for prioritizing and attacking these issues, HR faces a new and even graver risk of spinning in many directions and failing to achieve concrete improvements in any one area. The first order of business must be to identify the roles that are most critical for the business strategy in 2023 and beyond. That is, which roles are most critical and for which of these roles is talent already scarce? What business risks exist if these critical roles are vacant or if the talent within them unexpectedly leaves? What are the measurements of performance for critical roles in an intellectual capital world? How can these deliverables be managed especially on a remote basis? How can managers be enabled to measure intangible output (intellectual capital) in a remote environment? Answering these questions will provide HR with a priority group of roles to examine and, then, a roadmap of where to begin, and which results are most important to the business. Remember, HR has limited resources and always will; we can't try to do everything for everybody because we will then fail at everything. Therefore, using the business strategy - and the building of enterprise value through intellectual capital and critical roles - is the most effective way to design your post-pandemic talent strategy and priority outcomes.

New Solutions

New approaches are needed immediately to mitigate the impact on talent availability, retention and engagement – and for making strategic – and very different – talent investments. For example, planning for a higher number of unpredictable, yet rational, risks may warrant investment in building new internal or external pipelines of talent for certain roles that are deemed essential to your post-virus recovery plans. There may be roles for which borrowing (i.e. contracting) talent will be a necessary alternative where it had not been in the past. The key to ensuring successful business recovery is to plan for multiple alternatives and secure the ability to execute those plans.

Where do we start? By investing in the talent in the roles that are most critical to achieving the 2023 (and beyond) business strategy. This work must be prioritized by HR in order to become a true partner to the business.

Some key questions to answer: What are the critical roles in your organization for which vacancy is not an option in order for your business to achieve its goals? These are roles that truly create the value in your business. What is the steady state availability of that talent and what can you expect in the way of availability in the next 2-3 years? What risks exist relative to potential turnover or succession? What current scenarios heighten those risks for people in those most critical roles?

The hiring and retention of top talent in business-critical roles is, above all else, the key to business recovery.

No doubt we have more challenging times ahead of us but being positioned to address them while we accelerate business results through talent is the strategic imperative. This will require different and rapid talent planning efforts that must be developed and institutionalized now.

In this way, the HR function, which is responsible for the organization’s talent strategy, is the key lever to business growth in 2023 and beyond.

Co-Authored By:

Tom McGuire, Managing Partner (Former CFO of Revlon, Inc. and global head of Talent Acquisition, The Coca-Cola Company)

Linda Brenner, Managing Partner (Former talent acquisition and talent management leader at Pepsi and The Home Depot)

Need help designing or updating your talent strategy? Contact us.

Share this Article

Learn more about our unique approach to Talent Strategy Formulation.