Strategic Human Resource Management: Not All Employees Are Equal

In the last few years, McKinsey, Corporate Executive Board, PwC and others have concluded that HR still has "far to go" until it reaches the status of a true business enabler. While the tone of these studies might be different and the "pile on" mentality seems new, what's not new are many of the conclusions: the global environment is complex, talent is hard to find, employees need to be re-engaged, HR metrics are underutilized, and so on. But this has been clear for years, has it not? Nothing has dramatically changed about the way HR works or is viewed by the business in many organizations. In fact, the entire paradigm on which HR exists is fundamentally wrong in the new economy, thus creating need for strategic hr.

Here are six reasons why strategic human resource management matters today:

1 - The traditional human resource management model is no longer relevant

The mission of HR - that attending to the needs of employees is paramount to the success of the organization - has remained largely unchanged even while the nature of business and employment has dramatically evolved over the last 30+ years. HR posits that employees are generally equal, HR should be their advocate, and people-related programs should be rolled out unvaryingly and applied consistently. Where this approach may have once worked, it is no longer sustainable or measurable and therefore does not drive the value that businesses demand. The traditional approach to HR must be replaced with a strategic human resource management model to drive true value.

2 - Value is created in a dramatically different way than it was years ago

Not long ago, the value of companies was based largely on the worth of their tangible assets. Machinery, equipment, assembly lines, physical stores - and the assembled labor that worked them - made up the lion's share of market value. There was very little difference between the book value of companies like Chrysler or Bethlehem Steel or TWA and their market value. Today, however, it doesn't take much financial acumen to know that the value of companies like Google, Facebook and eBay have almost nothing to do with the value of their tangible assets. Generating intangible assets is the bottom line goal of a strategic human resource management approach.

3 – The difference between market value and book value across industries is now vast

So what makes up the difference between the book value and market value of a particular company? Intangible assets – predominantly “intellectual capital” - that remains off the books (acquisitions notwithstanding). These are non-physical assets which are expected to create future value for the business - think brands, patents, strategic relationships, proprietary operating procedures, databases, etc. In a company like P&G, where intangible assets make up more than 95% of the value of the company, great brands (Bounty, Tide, Gillette, etc.) drive a huge amount of value. At Merck, big brands (i.e., Singulair, Nasonex), patents, R&D and other IP account for nearly 90% of the company's value.

4 - Intangible assets are of no value without human capital

All of these assets - brands, patents, global reach, methodologies, trademarks, etc. - are inert. In and of themselves, they do nothing. Their success and value is entirely dependent upon the human capital managing them. And not just people - but the way in which knowledgeable talent is structured, the management processes through which they work, the way in which they are hired, developed, rewarded and retained, and so on. If even one of these human capital elements is ineffective – intangible asset value goes unrealized.

5 - Some parts of the business add more value than others

Everything you need to know about the financial well-being of a publicly held company can be found in the information they reveal to analysts and shareholders. It's relatively easy to cull through the data to identify the value attributed to intangible assets in a company, and what comprises that figure. For instance, in our Merck example, we know that 13,600 employees worked in R&D for the company in 2012, 22 products were in Phase II development, 16 products were in Phase III development and $8.2B was spent on the effort. Clearly, R&D drives a lot of market value for Merck. There are also lots of talented finance, legal and operations folks at Merck too, but they’re not driving nearly the same market value.

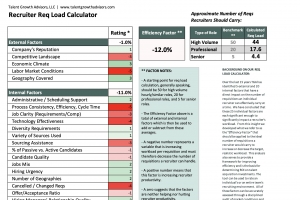

6 - HR resources, which are invariably limited, should be focused on the most value-adding parts of the business

The old model of spreading HR resources evenly throughout the business - and rolling out strategic human resource management programs and initiatives to everyone in the same way - no longer makes sense, if it ever did. Human resources are limited and they must be deployed in a way that will have the greatest impact - and generate the greatest value - for the organization. Companies should overinvest in the org design, sourcing, selection, performance management, talent review, leadership development, etc. of those functional areas that will net the greatest payoff.

By making this strategic shift, and identifying and concentrating on the mission-critical parts of the business, key metrics are able to more accurately assess the effectiveness of strategic human resource management investments. A spotlight can then be shone on measures like quality of hire, predictive selection, the return on human capital technologies, etc., with confidence (and proof) that they drive market value. The first step, however, is human resources adapting its approach to demonstrate this understanding, lest it remain on the sidelines – and in the cheap seats – of business.

Contact us; we'd love to hear from you! You may also want to read The Future of HR and An Annual HR Plan to Showcase HR as an Investment, Not a Cost.

Share this Article

Learn more about our unique approach to Talent Strategy Formulation.