92% of Corporate Value Is Now Intangible – YET Most Talent Strategies are Still Built for 1975

By Tom McGuire | February 11, 2026

The latest Ocean Tomo Intangible Asset Market Value Study should stop every CHRO in their tracks.

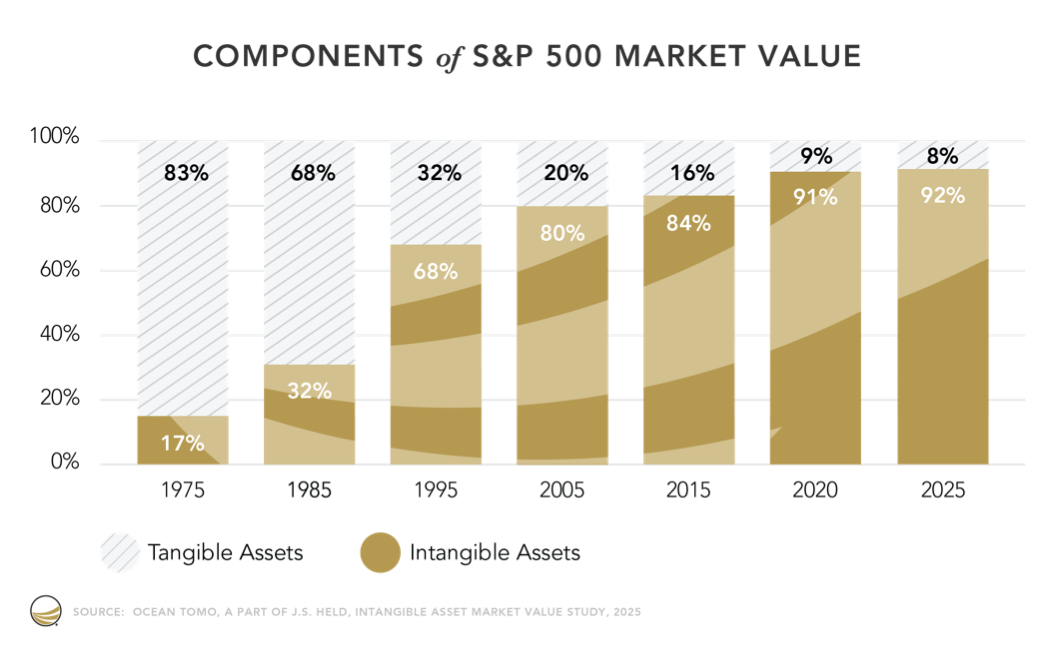

In 1975, 83% of the S&P 500’s market value was tied to tangible assets — property, equipment, inventory. Only 17% was intangible. Fast forward to 2025, and the numbers have completely flipped: 92% of market value now sits in intangible assets. Only 8% is tangible.

Ocean Tomo calls this “economic inversion.” Value has migrated from what can be touched to what can be thought.

That’s not just a financial observation. It’s an HR mandate.

Because intangible assets — brands, proprietary data, patents, algorithms, customer relationships, software platforms — do not generate themselves. They are produced, enhanced, protected, and scaled by people. Which means the primary driver of enterprise value is no longer capital equipment or real estate. It’s talent — specifically the talent working in the roles that create and safeguard intellectual capital (IC).

And yet, most HR investment strategies still treat roles as broadly equivalent. Headcount is allocated by geography, by level, or by business unit. Recruiting budgets are spread evenly. Performance management systems are one-size-fits-all. Succession planning is generic.

That made sense in an industrial economy powered by tangible assets – but it makes no sense in a 92% intangible economy.

Ocean Tomo’s data confirms what many executives intuitively understand, and what we've been writing about for a decade now: companies are valued based on what their people know, build, protect, and innovate. The surge in intangible asset market value between 1985 and 2005 — a 47-point increase in just two decades — marked the acceleration of this shift. And the fact that intangible value held steady near 90% through aggressive monetary tightening from 2020–2025 suggests something even more important: intellectual capital has become structurally embedded in corporate value.

For CHROs, this reframes the entire conversation about talent strategy.

If 90%+ of enterprise value is intangible, then the roles directly responsible for generating that value are not just important — they are existential. These are not necessarily the most senior roles. They are the roles tied directly to intellectual capital creation: product architects, brand strategists, R&D scientists, software engineers, commercial leaders managing strategic accounts, data scientists, IP attorneys, platform designers.

-

The first lesson from Ocean Tomo’s research is this: you cannot manage all roles the same way in an intangible economy.

-

The second lesson: if you don’t know which roles create your company’s intellectual capital, you are flying blind.

This is where Talent Valuation becomes critical.

Talent Valuation connects business value to intellectual capital to critical roles. It starts not with HR frameworks, but with the company’s investor presentations and strategy documents. What does the company say drives growth? Where is margin expansion coming from? What capabilities are repeatedly highlighted? Those clues point to where intellectual capital is created.

From there, CHROs should identify the roles directly responsible for delivering that work. Interview a select group of business leaders. Pressure test assumptions. Map value creation to actual job families. In almost every organization, the list of truly IC-essential roles is smaller than expected — and more concentrated.

Once identified, those roles must be managed differently.

In a 92% intangible economy, investing equally across all roles is a misallocation of capital.

Concrete steps CHROs can take:

-

Define IC-Essential Roles. Using the tips above, build a short, evidence-based list of roles directly tied to intellectual capital creation or protection. Do not boil the ocean. Start with 10–20 roles.

-

Differentiate Talent Investment. Recruiting for IC-critical roles should not follow the same budget, timelines, or sourcing strategy as high-volume operational hiring. The same applies to retention bonuses, development programs, succession planning, and workforce analytics.

-

Measure Quality of Hire in IC Roles. Track performance and retention specifically for these roles. Are you retaining your highest-performing IP creators? Are your best innovators leaving? Are you hiring from the right competitive sources?

-

Align HR Investment to Market Value. When asking for budget increases, link talent investment to intellectual capital protection and growth. If the market values your company primarily for software, brand equity, or proprietary data, your talent investment case should reflect that reality.

-

Stress-Test Retention Risk. Ocean Tomo notes that intangible value can be impaired by enterprise and regulatory risk. Talent risk is part of that. What happens to your valuation story if three key IC contributors out of a team of 10 leave? Most organizations cannot answer that question.

-

Shift the Workforce Planning Conversation. Instead of planning by geography or headcount totals, or even by level, plan by capability. Which capabilities, if underfunded, would directly erode intellectual capital?

The regional data in the Ocean Tomo study reinforces this urgency. The U.S. sits near 90% intangible value. Europe holds steady at 70–75%. Japan has surged. Asian markets show volatility tied to regulatory and governance shifts. These differences highlight that intangible value is not automatic; it is sensitive to governance, regulation, and strategic focus. Talent strategy must be equally disciplined.

The industrial revolution required companies to master machinery. The intangible revolution requires companies to master the identification and deployment of high-impact talent. CHROs who continue to spread talent investments evenly will struggle to demonstrate ROI. CHROs who explicitly tie talent decisions to intellectual capital creation and talent availability will speak the language of valuation. Ocean Tomo’s research is not just a financial study. It is a signal.

Value now resides in knowledge. The only source of knowledge is talent.

The question for HR is simple: are your talent strategies built for the economy your investors see — or the one that existed fifty years ago?

Email Updates

Get notified when we update our blog.

Learn More

Not All Employees Are Equal: The Importance of Strategic Human Resource Management

Read ThisLearn more about our unique approach to Talent Strategy Formulation.

Our Bloggers

Linda Brenner

Linda is an industry vet with keen observations and a knack for calling it like it is.

Tom McGuire

Tom brings the unlikely blend of Finance & HR to the practice, illuminating readers with the link between talent and business value.